Global Startup Funding Trends 2025 An In-Depth Data-Driven Analysis by EliteAge Research and Analytics

- EliteAge Research & Analytics

- Jan 26

- 4 min read

The startup funding landscape in 2025 reveals significant shifts shaped by evolving investor priorities, regional economic changes, and sector-specific growth patterns. This analysis offers a detailed, data-backed snapshot of global startup funding trends, highlighting geographical dynamics, sector breakdowns, investor behaviors, and a forward-looking perspective for 2026. EliteAge Research and Analytics provides insights to help entrepreneurs, investors, and industry watchers understand where the startup ecosystem is heading.

Geographical Dynamics of Startup Funding in 2025

Startup funding in 2025 continues to concentrate in established innovation hubs, but emerging regions are gaining momentum. North America remains the largest recipient of venture capital, accounting for approximately 45% of global startup funding. The United States, particularly Silicon Valley, New York, and Boston, leads with over $120 billion invested in startups this year.

Asia shows remarkable growth, with China, India, and Southeast Asia collectively capturing 35% of global funding. China’s funding volume reached $70 billion, driven by strong government support and a growing number of tech unicorns. India’s startup ecosystem attracted $25 billion, fueled by fintech and healthtech sectors. Southeast Asia’s combined funding hit $15 billion, with Singapore and Indonesia as key players.

Europe’s share stands at 15%, with the UK, Germany, and France leading. The UK attracted $18 billion, supported by fintech and AI startups. Germany and France combined raised $20 billion, focusing on industrial tech and green energy startups.

Emerging markets in Latin America and Africa are gaining attention, though their share remains below 5%. Brazil and Mexico lead Latin America with $4 billion in funding, while South Africa and Nigeria are the main hubs in Africa, collectively raising $1.5 billion.

Key Takeaways on Geography

North America dominates but growth in Asia is accelerating.

Europe maintains steady investment with focus on sustainability.

Emerging markets show potential but need more investor confidence.

Sector Breakdown of Startup Funding

The sector distribution of startup funding in 2025 reflects global economic priorities and technological advancements. The top sectors by funding volume are:

Artificial Intelligence and Machine Learning: $60 billion

AI startups attracted the highest funding, driven by applications in automation, healthcare diagnostics, and financial services. Companies developing generative AI and natural language processing tools saw the largest rounds.

Fintech: $50 billion

Fintech remains a major focus, especially in payments, digital banking, and blockchain technology. Startups offering embedded finance solutions and decentralized finance platforms raised significant capital.

Healthtech and Biotech: $40 billion

Healthtech startups benefited from ongoing digital transformation in healthcare, telemedicine, and personalized medicine. Biotech firms working on gene editing and novel therapies also attracted large investments.

Climate Tech and Clean Energy: $30 billion

Funding in climate tech increased by 25% compared to 2024. Startups developing renewable energy solutions, carbon capture technologies, and sustainable agriculture innovations gained investor interest.

Enterprise Software and SaaS: $28 billion

Enterprise software startups focused on cloud computing, cybersecurity, and workflow automation secured substantial funding rounds.

Other sectors such as e-commerce, mobility, and education technology also saw healthy investments but at lower volumes.

Sector Highlights

AI leads due to broad applicability and rapid innovation.

Fintech’s growth is supported by regulatory changes and consumer demand.

Climate tech funding reflects rising environmental concerns and policy support.

Investor Behaviors and Funding Patterns

Investor behavior in 2025 shows a cautious yet opportunistic approach. The total global venture capital funding reached $250 billion, a 10% increase from 2024, but deal sizes and valuations became more scrutinized.

Funding Stages

Early-stage funding (seed and Series A) accounted for 40% of total deals but only 25% of total capital. Investors focus on startups with clear product-market fit and scalable business models.

Growth-stage funding (Series B and beyond) attracted 60% of capital, reflecting confidence in startups with proven traction.

Mega-rounds ($100 million+) increased by 15%, mainly in AI, fintech, and healthtech sectors.

Investor Types

Venture Capital Firms remain the largest source of funding, contributing 70% of total capital.

Corporate Venture Capital increased its share to 15%, with tech giants and financial institutions investing strategically.

Angel Investors and Accelerators focus on early-stage startups, providing mentorship alongside capital.

Private Equity and Family Offices showed growing interest in late-stage startups and pre-IPO rounds.

Regional Investor Trends

North American investors lead in deal volume and size.

Asian investors, especially in China and Singapore, are more active in early-stage deals.

European investors emphasize sustainability and impact investing.

Outlook for 2026

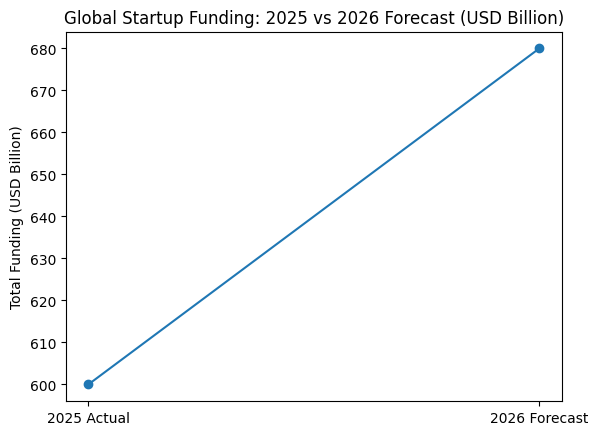

Looking ahead, startup funding in 2026 is expected to grow moderately, with an estimated 8-12% increase in total capital deployed. Key trends to watch include:

Increased focus on sustainability: Climate tech and circular economy startups will attract more funding due to regulatory pressure and consumer demand.

Expansion of AI applications: AI startups will diversify into new industries such as agriculture, manufacturing, and education.

Greater investor selectivity: Investors will prioritize startups with clear paths to profitability and strong governance.

Rise of decentralized finance and blockchain: Regulatory clarity may unlock more capital for blockchain-based startups.

Growth in emerging markets: Latin America and Africa will see increased venture capital activity as infrastructure and digital adoption improve.

EliteAge Research and Analytics View

EliteAge Research and Analytics sees 2025 as a pivotal year for global startup funding. The data shows a maturing ecosystem where investors balance enthusiasm with discipline. Geographic shifts indicate a more multipolar startup world, with Asia and emerging markets gaining ground.

Sectors like AI and climate tech are not only attracting capital but also driving innovation that addresses real-world challenges. Investors are increasingly looking for startups that combine technology with sustainability and social impact.

For entrepreneurs, understanding these trends is crucial. Building startups that align with investor priorities and global needs will improve chances of securing funding. For investors, focusing on quality, diversification, and emerging regions offers opportunities for strong returns.

Practical Insights for Startups and Investors

Startups should consider these practical steps to align with 2025 funding trends:

Develop clear value propositions in AI, fintech, or climate tech.

Demonstrate measurable impact and sustainability credentials.

Build strong governance and financial discipline early.

Explore partnerships with corporate investors for strategic support.

Target emerging markets with tailored solutions and local knowledge.

Investors can enhance their strategies by:

Diversifying portfolios across sectors and regions.

Engaging in early-stage deals with hands-on support.

Monitoring regulatory developments, especially in fintech and blockchain.

Supporting startups that address environmental and social challenges.

Leveraging data analytics to identify promising startups early.

Comments